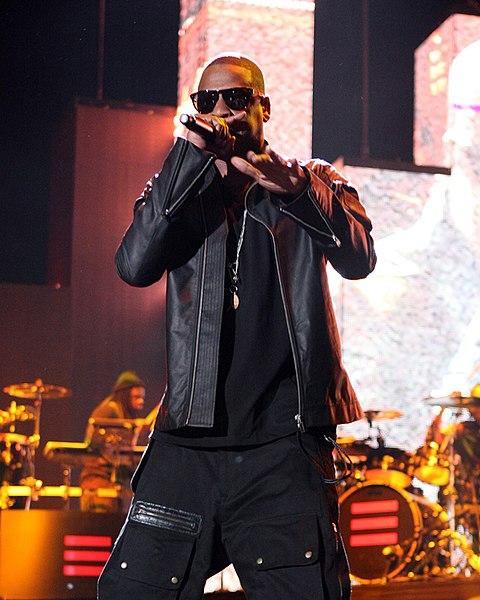

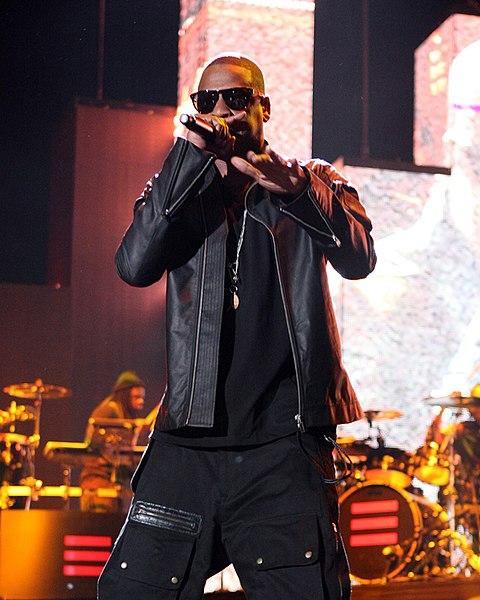

Hip-hop star Shawn Carter, aka Jay-Z, has just received a subpoena to appear in court after he failed to testify in connection with the SEC’s probe into Iconix Brand Group’s accounting practices.

Iconix acquired intangible assets from Jay-Z’s clothing brand Rocawear in 2007, which boasted $700 million in annual sales at the time. The agreement was that Carter and Iconix would work on the joint development of new brand opportunities following the sale. But Iconix went on to announce two write-downs of Rocawear, one in 2016, of $169 million, and another one of $34 million earlier this year.

Iconix, which describes itself as, “the world’s premier brand management company and owner of a diversified portfolio of strong global consumer brands across fashion, sports, entertainment, and home,” markets retail brands such as Joe Boxer, Candie’s, Bongo, Pony, Umbro, and Material Girl.

FINRA Lawyer Blog

FINRA Lawyer Blog